High Spenders On Shopping Craze In Australia

- Australia owes the 10.2% growth in its luxury retail industry to Chinese consumers

- High spenders now seek more unique, creative brands

- Majority of successful luxury brands work with KOLs to reach their target audience and tell their brand story

Australia has Chinese tourism to thank for a 10.2% growth per year since 2013 in Australia’s luxury retail industry, according to IbisWorld. It is also estimated that Chinese shoppers make up two thirds of overall luxury retail sales in Australia. Chinese millennials are the driving force behind China’s appetite for luxury fashion, accounting for more than half of the total spending on luxury by Chinese consumers in 2018, according to The China Luxury Report 2019. Without the influx of Chinese tourists and Chinese students in Australia, this boom would not be possible, but more can be done to ensure this trend continues to benefit Australia’s fashion industries.

Australian designs have the potential to break through to China’s market

Whilst sales are skyrocketing for the Australian stores of world-renowned brands, such as Louis Vuitton, more could be done to create a presence for smaller Australian designers in China itself. Australian designs have captivated the world, whether its Kendall Jenner sporting an Anna Quan dress or Meghan Markle showing off her Camilla and Marc blazer, yet this success has not broken through to China’s market.

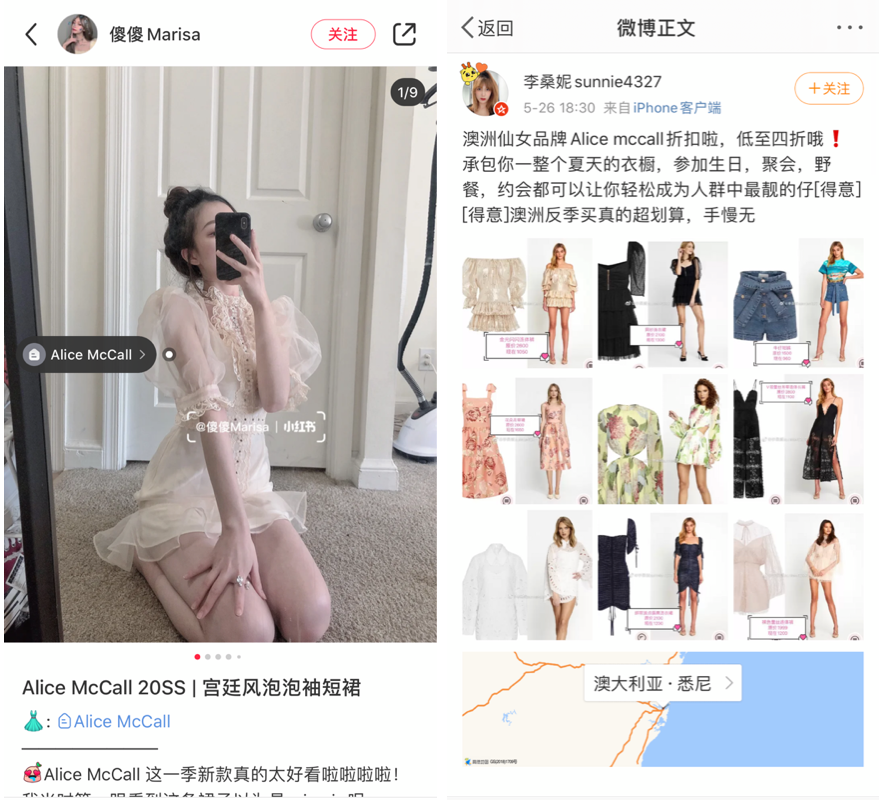

As the second largest economy in the world according to World Bank, the Chinese market appeals to many businesses. Yet the vast cultural differences of China, in which Western social medias are blocked, has left business unaware how to market towards the Chinese. Australian designer Alice McCall has proved that breaking into the Chinese market is easier than you may think. Daigou, literally translating to ‘Surrogate Shopping’, is a form of cross border shopping in which an individual will travel outside of China to shop for the goods required by their client. Despite this practice being practically unheard of in Western culture, designer McCall was quick to utilise Chinese Daigou, offering private appointments in some of her stores and even video chatting Daigou on popular Chinese social media app WeChat. Her understanding of the Chinese market has resulted in 80% of her trade coming from Chinese customers, a figure she revealed in an interview to The Sunday Morning Herald. Whilst McCall was able to utilise Daigou, according to Chinese Economic Weekly, the Electronic Commerce Law of 2019 has rendered it nearly impossible for Daigou to profit from their work due to high taxation. New distribution channels can be utilised in place of Daigou. Taobao, often described as China’s amazon, includes shops owned by Chinese fashion KOLs that sell products from other brands straight into the hands of their loyal followers. Other apps such as TMall and WeChat have the same potential for stores in which businesses can drive traffic via KOLs.

Utilising KOLs to appeal to high spending millennials

Fashion industries must be open to explore other avenues that differ to Western norms but will appeal greatly to the Chinese market. Chinese millennials make up one of Chinas highest spending demographic, spending an average of 41,000 RMB ($8,435 AUD) per person, per year on luxury alone according to The China Luxury Report 2019. Now is the time for Australian brands to appeal to this demographic due to a new trend in which millennials stir away from classic luxury brands in the search for a more unique look.

The most effective way of appealing to this demographic is through utilising Chinese social media influencers, or KOLs. Fashion KOLs heavily influence their viewers shopping behaviours. Therefore, photos of a fashion KOL sporting an Australian design has the potential to introduce Australian designers to millions of Chinese viewers and immediately sell via ecommerce plug ins. Inviting Chinese designers to Australian fashion shows could further bridge the gap between the Australian and Chinese fashion industries, with both parties involved having access to vital advice on each countries market. This years ‘Fashion Week Australia’ took place at the Chinese Garden of Friendship. This venue perhaps reflects that the Australian fashion industry has recognised that attracting Chinese consumers would greatly benefit Australian brands. Fashion shows in general have the potential to lure Chinese millennial consumers with 75% of interviewees stating they would attend fashion shows over other events associated with fashion in The China Luxury Report 2019.

The power of KOLs

The fashion industry has recognised the impact that Chinese KOLs have the potential to make. Luxury fashion brands such as Givenchy, Gucci and Louis Vuitton have often utilised Chinese fashion KOLs to appeal to the Chinese market. Tao Liang, better known as Mr.Bags, has an impressive WeChat following of 3.7 million followers. After partnering with Givenchy, his bags sold out in a mere 12 minutes generating roughly 1.2 million RMB ($248,299 AUD), according to ChinaChannel. The bags were promoted merely through a post on Liang’s WeChat account that at the time had 1.2 million followers. This is not to say that successful collaborations rely on big brand names. Fashion KOL Becky Li’s partnership with designer Rebecca Minkoff experienced similar success with the collaborations 1,200 bags selling out in just two days. Fashion KOLs have such an influence over their viewers to the extent that with collaboration, their followers will trust brands they otherwise may have never heard of. Utilising fashion KOLs would be the perfect way for Australian designers to gain the trust of Chinese consumers.

Chinese consumers already associate Australian fashion with luxury as seen by the Chinese consumer boom in luxury brands across the country. With an understanding of Chinese consumer patterns, Australian designers can break through to the Chinese market.